Introduction to COBRA Insurance

Health Insurance was the most stressful part of my life ever since I was personally into it a couple of years ago. I didn’t know at all what was going on. COBRA is a plan that has many counterparts which add to the confusion to the readers. This work address COBRA policy pros, who may be covered and why this may be of benefit to you.

What is COBRA Insurance and Who is Eligible?

COBRA law is a federal law which enables people who deal with significant life changes to stay on their former job plan for a short time as support. Example of the events are dismissal from work, overtime hours reduction, divorce, or death of the family members or partner.

COBRA eligibility is employer size based and circumstances specific regarding the coverage loss. Specifically, COBRA covers health benefit plans offered by firms with at least 20 employees and health benefit plans maintained by state or local governments.

Benefits of COBRA Insurance – What is COBRA Insurance

COBRA premium assistance for it provides continuation of the health plan when you lose the job or meet other life-changing circumstances. It is crucially important when you are going through treatment of a chronic illness or otherwise a disease. In the end, the renewal of the insurance will prevent the situations when you need to switch to the different plan and suffer a disruption of the coverage without any gaps.

Through COBRA, you can secure the same level of benefits as before. This approach means, that you don’t need to worry about amending your deductibles, copays or the number of your benefits.

Eligibility for COBRA Insurance – What is COBRA Insurance

Being eligible for the COBRA health plan means that the person must have been a part of another group health plan and experienced a qualifying reason. Qualifying events can include: What is COBRA Insurance

Resignation of choice or not by choice (unless gross misconduct)

Reduction in work hours

Divorce or legal separation

The demise of the insured worker.

Becoming eligible for Medicare

Loss of independent adulthood.

This is correct, COBRA is cannot be applicable unless there were at least 20 employees for the employer in the last year, which is a calendar year.

How Does COBRA Insurance Work?

A competent event requires your employer to inform you of your COBRA rights and give you the needed papers to enlist. Then, you would be given about two months to make a decision on electing the COBRA coverage.

When you decide to COBRA, you will then have to pay the entire premium amount as well as a 2% administrative charge. The fact is that COBRA premiums might be more than what you used to pay while employed and that is because the employer’s part has been eliminated.

COBRA Insurance Coverage and Costs

The coverage of COBRA is the same as that of the health insurance plan you were under and any deductibles, copays, and coverage limits are also included. In contrast to before, you will pay the whole premium by yourself which may be higher than the cost you have to pay when you were an employee.

The cost of COBRA coverage varies from one plan to another in addition to your location. Nevertheless, in general, it is most likely to be more expensive than the premiums that you were paying when you had your job. COBRA monthly cost varies from $400 to $700 per individual and from $1,000 to $2,000 per family coverage on average.

COBRA Insurance premiums

The other major COBRA issue is the premium price. Nowadays, the employee needs to pay a full amount of their policy which can be much higher than before being part of an employer-sponsored plan. COBRA premiums generally lie between 102% and 150% of what the employer would have paid for the coverage.

COBRA Insurance enrollment – What is COBRA Insurance

The only person who must complete and file the COBRA election form within the time stipulated, which is usually 60 days from the qualifying event or from the date on which the COBRA election notice was received, is the individual. Therefore, a person will be required to pay first month’s premium which will be charged by the insurance company on the day of the qualifying event.

COBRA Insurance duration – What is COBRA Insurance

Originally, the COBRA insurance was for 18 months, but the duration was different depending on the qualifying events. As for instance, the spouse and dependents might be enrolled in COBRA for 36 months in case the causing event was the employee’s death.

How to Enroll in COBRA Insurance

To enroll in COBRA, you’ll need to follow these steps: COBRA stands for Consolidated Omnibus Budget Reconciliation Act.

Tell them about the reason of your nonvoluntary coverage discontinuation.

Ask your employer for the COBRA election letter you were enrolled in that explains the terms and the enrollment procedure.

Use COBRA enrollment rules; include the form when filing within the deadlines that are provided, mostly 60 days.

It is worth mentioning that you have to pay first monthly premium before its due date to avoid that gap in cover.

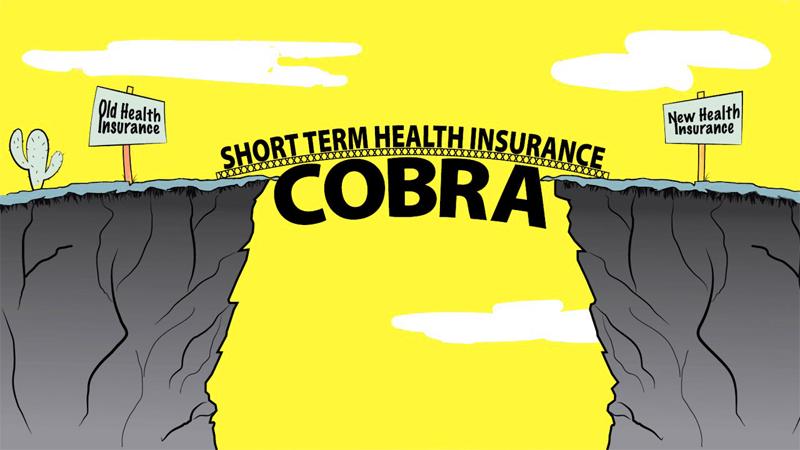

Alternatives to COBRA Insurance – What is COBRA Insurance

COBRA is a good policy for some people, but others can do better with more better plans. Depending on your circumstances, you may want to explore alternative healthcare coverage options, such as: What is COBRA Insurance

Enrolling in either my spouse’s health insurance plan or with my parent health insurance.

ACA marketplace is one of the avenues that an individual uses to get insurance cover.

The research of Medicaid and other health insurances policy in states.

For example, joining a group insurance association that exclusively serves young professionals or alumni.

Common Misconceptions about COBRA Insurance

One of the most popular myths on COBRA is that it is partially and wholly run and operated by the federal government. It was astonishing to learn that the fully paid COBRA is the federal piece of legislation that aims to provide health insurance to employees while the private health insurance program is the one that is supposed to offer benefits.

The final myth is that full COBRA covered is free of charge. The COBRA program offers you such a great opportunity to continue paying for your health insurance coverage, although it will be that you pay the full premiums plus an additional fee.

Frequently Asked Questions about COBRA Insurance

Up until how long does a divorcee or a widow can avail the COBRA benefits?

They are usually for a period of 18 months which may go up to 36 months in case there is a divorce or a spouse has expired.

Is it possible for me to revise COBRA plans before my insurance period expires?

Yes, that is allowed: while still being in the coverage period you can probably switch for the COBRA alternative pay offered by your employer provided you do this within the stipulated enrollment duration.

Conclusion: Understanding the Importance of COBRA Insurance

The workers whose employers no longer insure them can consider COBRA the insurer of the last resort. The second factor is the configurations of the clothes at your disposal in which case, you will absolutely be getting what satisfies you and your family so well in terms of fashion.

Whereas if you want to know more about COBRA or need help with determining eligibility, our customer service experts with healthcare backgrounds are available to you for your consultation during regular business hours. We are in favor of addressing your wishes of how to apply the plan and if it fits your budget plan.